Roofing Demand and Construction of New Housing Units to Surge by 2019, Reports Say

CLEVELAND, OH – August 14, 2015 – New studies from The Freedonia Group, Inc., a Cleveland-based industry market research firm, reveal a significant increase in roofing demand and new housing units through 2019.

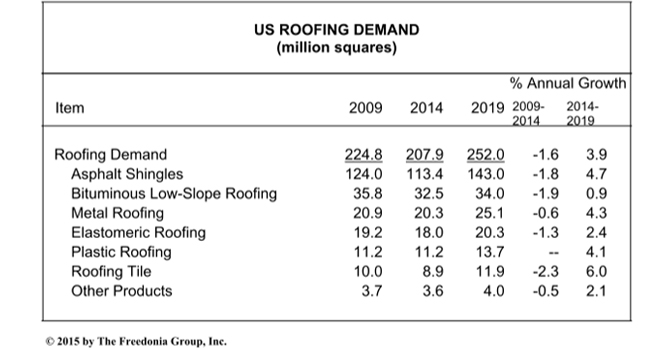

US Roofing Demand to Reach 252 Million Squares in 2019US demand for roofing is projected to advance 3.9 percent annually to 252 million squares in 2019, valued at $21.4 billion. This will be a rebound from the 2009-2014 period, spurred by strong advances in both residential and nonresidential building construction activity. As the residential market is expected to see the faster growth going forward, demand for steep-slope roofing is forecast to rise more rapidly than that for low-slope products. These and other trends are presented in Roofing, a new study from The Freedonia Group, Inc.

The new building construction market for roofing is anticipated to post faster gains than the reroofing market through 2019. In the new residential market, double-digit annual advances in housing starts will fuel demand for asphalt shingles, roofing tiles, and metal tiles and shingles. Reroofing accounts for the larger share of US roofing demand, totaling 81 percent in 2014. According to analyst Matt Zielenski, “This is actually a decline from 2009, when new construction activity was at a depressed level and the scope of damage caused by Hurricane Ike and other storms in 2008 boosted demand for replacement roofing in the following year.”

Asphalt shingles account for the largest share of roofing demand, due primarily to their dominance in steep-slope roofing applications. Demand for asphalt shingles is forecast to rise at an above average pace through 2019, spurred by the rebound in housing starts. Advances will also be supported by strong consumer interest in laminated asphalt shingles, which many homeowners feel improve the appearance and value of a residence.

Roofing tiles are expected to see the most rapid growth of all roofing products, driven by strong gains in housing starts in the South and West, where tiles are most often installed. Demand for roofing tiles will also be promoted by their favorable aesthetics and ability to be used as cool roofs. Among other products, plastic and metal roofing will also see above average demand gains. Plastic roofing will see increasing use in low-slope applications because of its ease of installation and favorable performance properties, while metal roofing demand will be supported by its durability and ability to support solar panels used to generate electricity.

RELATED UL Announces New Testing and Certification Services for the Building Envelope, Multifamily Surge Pushes Housing Starts Up 9.8 Percent in June , Sprayfoam 2016 Convention & Expo to be Held in Orlando , Demand for Construction Chemicals to Increase Nearly 8% Annually Through 2018

Construction of New Housing Units to Reach 62.6 Million in 2019

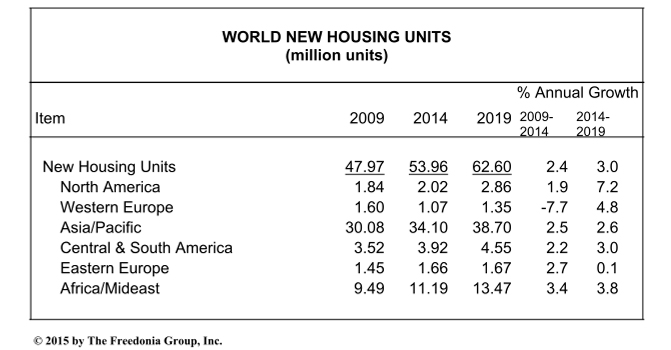

Worldwide construction of new housing units is forecast to increase 3.0 percent annually to 62.6 million units in 2019. While global population growth is expected to decelerate, declines in average household size will still allow the number of households in the world to increase 1.6 percent annually, boosting demand for new housing. In addition, increased rural-to-urban migration, especially in developing countries, will spur construction of new housing units in urban areas. These and other trends are presented in World Housing, a new study from The Freedonia Group, Inc.

North America and Western Europe are expected to experience the most rapid growth in new housing units through 2019. “In both cases, gains will be off a depressed 2014 base, with many countries recovering from the collapse of housing bubbles,” according to analyst Nick Cunningham. Several of the countries that experienced the most severe downturns, including the United States, Ireland, Italy, Portugal, and Spain, will experience double-digit annual increases in new housing units, although in most cases 2019 levels will remain substantially below those in 2004.

On a global basis, multifamily units are forecast to experience faster gains in new construction than are single-family units, the result of increasing urbanization in developing countries. Rural-to-urban migration will be particularly strong in the two most populous regions -- the Asia/Pacific and Africa/Mideast -- and those new urban residents will boost demand for multifamily housing. Construction of new multifamily units worldwide is forecast to advance 3.7 percent per annum through 2019; in that year, more than 80 percent of new housing units will be built in the Asia/Pacific and Africa/Mideast regions.

Growth in the housing stock is expected to outpace household formation through the forecast period, reaching over 2.2 billion units in 2019. Rising income levels over the forecast period will support the increases in housing stock per household through two means. First, some lower-income households will be able to move out of shared living quarters into their own housing units. Second, some affluent households will be able to afford the purchase of a second, leisure-time housing unit. The Asia/Pacific region will continue to account for slightly over half of the world’s housing stock during this time. The Africa/Mideast region, which had the second largest regional housing stock in 2014, is expected to register the fastest regional housing stock growth.

Roofing (published 06/2015, 454 pages) is available for $5500 from The Freedonia Group, Inc. For further details or to arrange an interview with the analyst, please contact Corinne Gangloff by phone 440.684.9600 or e-mail pr@freedoniagroup.com. Information may also be obtained through www.freedoniagroup.com.

World Housing (published 07/2015, 242 pages) is available for $5900 from The Freedonia Group, Inc. For further details or to arrange an interview with the analyst, please contact Corinne Gangloff by phone 440.684.9600 or e-mail pr@freedoniagroup.com. Information may also be obtained through www.freedoniagroup.com.

About The Freedonia Group, Inc: At Freedonia, our mission is to provide our clients with unbiased and

reliable industry market research and analysis to help them make

important business decisions. Freedonia delivers its market research in the form of off-the-shelf published research (Industry Studies and Freedonia Focus Reports) that may be accessed by the general public and through our wholly owned subsidiary, Freedonia Custom Research, Inc. by way of custom market research projects that are contracted for on behalf of, and for the exclusive use of, a single client.

For more information, please use the contact information provided below or visit their website.

Disqus website name not provided.